Why choose NOX Gaming financing?

Adapted Payments

Fast approval

Pay in affordable equal monthly instalments.

Instant credit available

Our financing plans allow you to spread the cost of a purchase over monthly or bi-weekly installments. Apply for any Affirm payment option without affecting your credit rating.

Shop at your favorite Affirm retailer and select them from the payment options at checkout.

Use your cell phone number to set up your PayBright account in less than a minute.

Confirm your financing plan, and voilà! Enjoy your purchase now and pay later.

How does IFXpress work? It couldn’t be simpler! Find out how you can submit your loan application in just a few minutes and get easy financing through IFXpress!

Submit your information by filling in the application form application form.

Get approved in minutes. Once you’ve submitted your application, an agent will contact you shortly to complete the process with you.

Create your financing contract on the IFXpress website and sign it electronically directly online using your phone or computer.

Contact us and we’ll complete your online order together. You can contact us on Messenger for faster service, or e-mail us at info@noxgaming.ca.

How does IFXpress work? It couldn’t be simpler! Find out how you can submit your loan application in just a few minutes and get easy financing through IFXpress!

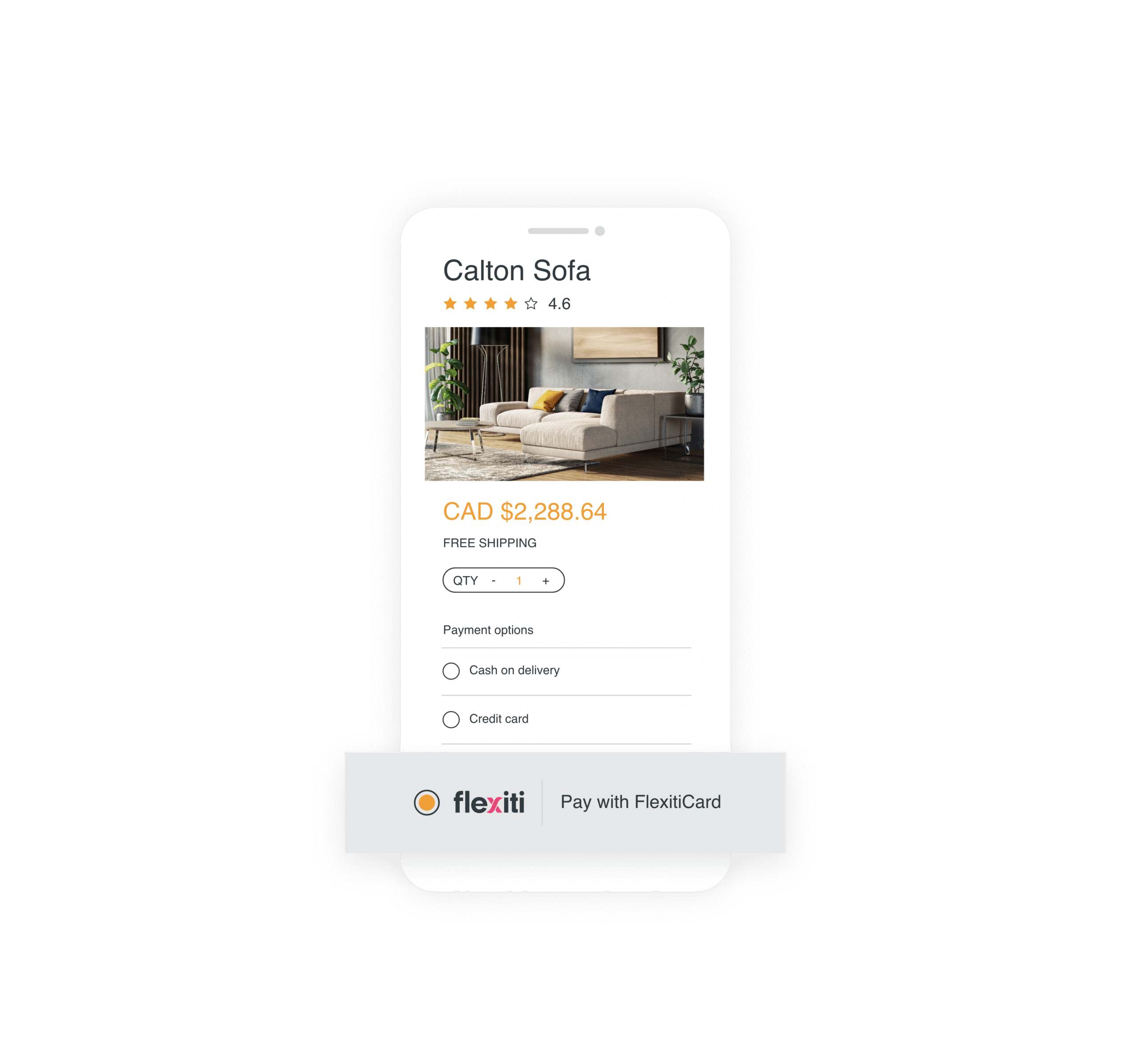

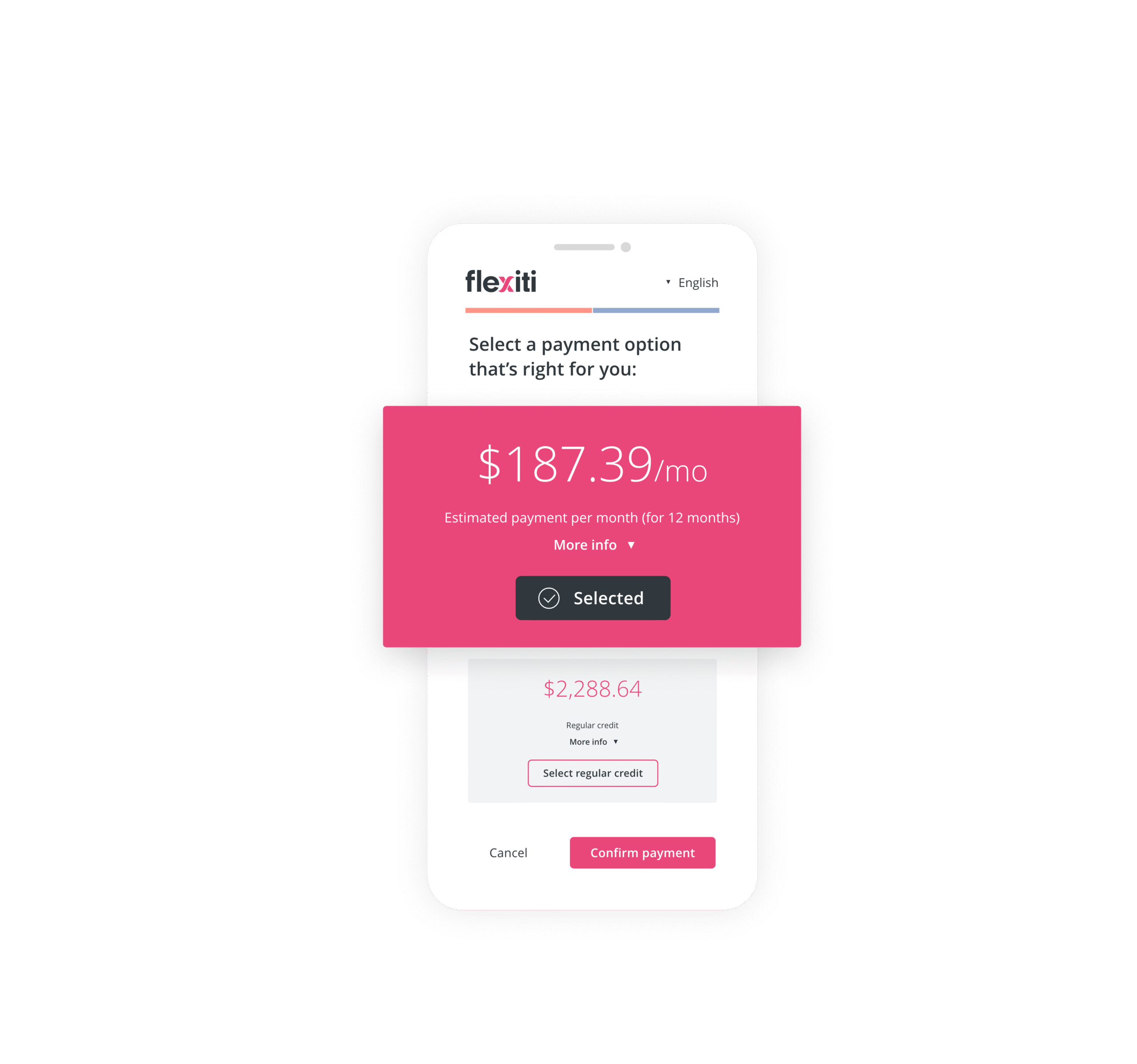

Directly in your shopping cart, select the Flexiti payment method, then press order. A window will appear.

If you’ve already used Flexiti, you can simply log in to your account, otherwise you can easily create an account to instantly finance your purchase.

We offer many options! You can choose the financing plan and term that suit your budget and goals.

You can easily confirm everything, and the window will close by itself. Your transaction will be completed shortly afterwards!

Repay your purchases at your own pace with CIBC PaceIt

CIBC PaceIt allows you to pay off eligible purchases on your credit card through lower interest installment plans. No credit check or approval required.

Step 1

Make your purchase with a CIBC MasterCard or Visa credit card. To ensure that your purchase is eligible, you can consult the eligibility criteria in the F.A.Q.

2nd Step

Through the CIBC portal, find the transaction in your credit card statement, then, in the transaction options, choose a payment plan option.

3rd Step

Read and accept the terms and conditions. Confirm the creation of the installment plan. It may take two or three business days to process your installment plan.

Will using Affirm affect my credit rating?

Creating an Affirm account and verifying your eligibility will not affect your credit rating.

Does Affirm charge fees and interest?

Expenses - We do not charge any fees. That means no late payment fees, no early repayment penalties, no annual fees and no account opening or closing fees.

Interests - However, your financing plan may be subject to interest, which is calculated according to the amount of your purchase and where you store. Our advertised interest rates won't change, and all terms and conditions are clearly set out at the outset, so you'll always know exactly what to expect.

What is pre-qualification?

At the time of pre-qualification, you are informed of the estimated amount you could spend with Affirm. You don't have to use the full amount or pay anything back until you've made a purchase. Your final entitlement is subject to eligibility criteria.

Can I use my PayBright credentials with Affirm?

PayBright is now called Affirm! When you make your first purchase with Affirm, you'll need to create a new account. If you already have a PayBright financing plan, you can access it and your account information at PayBright portal.

Can I pay off my loan at any time?

Yes, you can pay the balance of your loan at any time by logging directly into your your account. No penalty will be imposed.

I'm having trouble with my financing. Who can I contact?

You can reach the Affirm team at 1-877-276-2480.

Are there any financing deadlines after the order has been placed?

If you've ordered your computer with Affirm, you've been authorized.

However, as a fraud check, Affirm requires a period of 48 working hours before processing the order.

Does IFXpress charge fees and interest?

Expenses - We do not charge any fees. That means no late payment fees, no early repayment penalties, no annual fees and no account opening or closing fees.

Interests - However, your financing plan may be subject to interest, which is calculated according to the amount of your purchase and where you store. Our advertised interest rates won't change, and all terms and conditions are clearly set out at the outset, so you'll always know exactly what to expect.

What is pre-qualification?

At the time of pre-qualification, you are informed of the estimated amount you could spend with IFXpress. You don't have to use the full amount or pay anything back until you've made a purchase. Your final entitlement is subject to eligibility criteria.

Can I pay off my loan at any time?

Yes, you can pay off the balance of your loan at any time by calling customer support at 1-855-694-0960.. No penalty will be imposed.

Are there any financing deadlines after the order has been placed?

With IFXpress, if you're approved, we can assemble as soon as the loan is confirmed! Very fast service.

How do I apply for a Flexiti account?

Click on “Apply Now” to access Flexiti's quick and easy online application form, which can be completed in minutes!

How can I pay with Flexiti?

Shopping online? At checkout, choose Flexiti as your payment method. You'll then need to apply for a Flexiti account or enter your existing Flexiti account number. Then choose your financing plan and complete the purchase. It couldn't be easier!

How can I manage my account?

Simply register your account online at my.flexiti.com ! Once you've registered, you'll be able to view all your account details, including credit limits, outstanding balances, statements, financing plans and much more.

How do I make my payments?

You can easily pay using your caisse's or bank's online payment system - simply add Flexiti (Flexiti Financière) as a beneficiary!

How can I contact Flexiti?

Call 1-877-259-3745 or e-mail service@flexiti.com.

Where can I use FlexitiCard?

FlexitiCard is accepted at thousands of retail, in-store and online locations. To see where you can store, explore the Flexiti Network at flexiti.com/network.

What are the eligibility criteria for CIBC PaceIt?

- A purchase of $100 or more.

- A purchase made with an eligible CIBC credit card.

- A purchase made from an account in good standing. Secured, mortgaged or guaranteed accounts are not eligible.

- Transactions such as Payment Protector insurance interest, fees or premiums, cash advances, and pre-authorized debit transactions are not eligible for CIBC PaceIt Installment Plans.

- Your balance, including pending transactions, must be less than 90% of your credit limit.

- The purchase must be recorded in the current statement period and not yet appear on a monthly statement. A purchase recorded on the last day of the statement period or in a previous statement is not eligible.

- The request for an installment plan must be made by the primary cardholder.

Purchases eligible for installment plans will be marked “Eligible for installment plan” in mobile and online banking.

- Instalment plan requests must be made by the primary cardholder or authorized user making the purchase.

- The installment plan request must be made during the online payment procedure on the participating retailer's website.

- Participating retailers must activate installment plans as a payment option.

- If you make a purchase of $1,000 and make a payment of $200 on your credit card account, you won't be able to create an installment plan on the $1,000 purchase, because your applicable purchase balance is $800.

Can I combine several purchases into a single payment plan?

No. You cannot combine multiple purchases into one installment plan. You must create an installment plan for each eligible purchase.

Why are there different rates and fees for installment plans?

CIBC makes every effort to offer competitive rates and fees. Any payment plan option offered to you is based on the following criteria:

a) Your province of residence

b) The retailer where you made your purchases

c) Your credit card

How long does it take to process my installment plan request?

It may take 2-3 business days to process your payment plan.

Your installment plan will be processed and posted to your account at the time your purchase is posted to your account, subject to the terms and conditions of the installment plan.

Where can I find information about my installment plan?

Once you have opted for an installment plan, it may take 2 to 3 business days before you see the information.

There are several ways to find information about your installment plan.

CIBC Mobile Banking® :

- Log in and select your credit card

- From the Summary tab, go to “More options”, then select “CIBC PaceItTM ”.

CIBC Online Banking® :

- Log in and select your credit card

- Click on the “Manage my map” button and select “CIBC PaceIt TM ”

This information will also appear on your monthly credit card statement. Find out more about the monthly credit card statement.

What effect does using CIBC PaceIt have on my available credit?

Using CIBC PaceItMC has no impact on your available credit. The initial purchase amount is automatically deducted from your available credit. As you make monthly payments, the amount you repay is added to your available credit.

Are there any fees if I choose CIBC PaceIt?

A one-time set-up fee may apply to your installment plan request. If applicable, this fee will be communicated to you before you request the creation of your installment plan. The one-time set-up fee, if applicable, will be billed on the first monthly credit card statement after the installment plan is created. The fee will be included in your minimum payment and total balance. This fee does not apply to Quebec residents.

Example: If you set up a CIBC PaceIt installment plan for the purchase of a new $900 sofa, the one-time set-up fee will be $18.00 (i.e. 2% of $900).

Can I make additional payments to my installment plan?

If you pay more than the amount due, the excess amount is applied to unbilled purchases and plan payments not yet due at that time.

To find out how we apply your payment, see the “Payment Application” section of the CIBC Cardholder Agreement (PDF, 230 kb)A new window will open. .

For the CIBC Costco®† Mastercard® business card, see the cibc sme credit card agreement(personal liability) (PDF, 135 KB)A new window will open.

What happens if I don't make the minimum payment?

If you miss the minimum payment or pay only part of it, interest at the annual rate applicable to regular purchases associated with your credit card is charged on the unpaid principal of your payment. Interest accrues from the first day of the period covered by the next statement following the payment you missed. Interest is added to your account at the end of each statement period. We do not charge interest on interest.

Any other questions?

Visit the CIBC PaceIt information page.